When you need funds for a major purchase, debt consolidation, or an unexpected expense, choosing between online personal loans and traditional bank loans can be a tough decision. Both options offer unique advantages and drawbacks, depending on your financial needs and preferences. This guide compares the two, highlighting their pros and cons to help you make an informed choice, no matter where you are in the world.

What Are Online Personal Loans and Traditional Bank Loans?

Online Personal Loans

Online personal loans are offered by digital lenders, such as fintech platforms or online-only financial institutions. These loans are typically unsecured, meaning no collateral is required, and are applied for entirely online, with funds often disbursed quickly.

Key Features of Online Personal Loans:

- Fast Application Process: Apply from anywhere with an internet connection.

- Quick Funding: Funds can be available within hours or days.

- Flexible Eligibility: Often accessible to borrowers with varying credit scores.

- Fixed Interest Rates: Predictable payments for easier budgeting.

Traditional Bank Loans

Traditional bank loans are provided by physical banks or credit unions, often requiring in-person applications or visits. These loans can be secured or unsecured, with terms influenced by your relationship with the institution and credit profile.

Key Features of Traditional Bank Loans:

- Lower Interest Rates: Often competitive rates for those with strong credit.

- Personalized Service: Direct interaction with loan officers.

- Varied Loan Options: May include secured loans with collateral.

- Longer Approval Process: More documentation and time required.

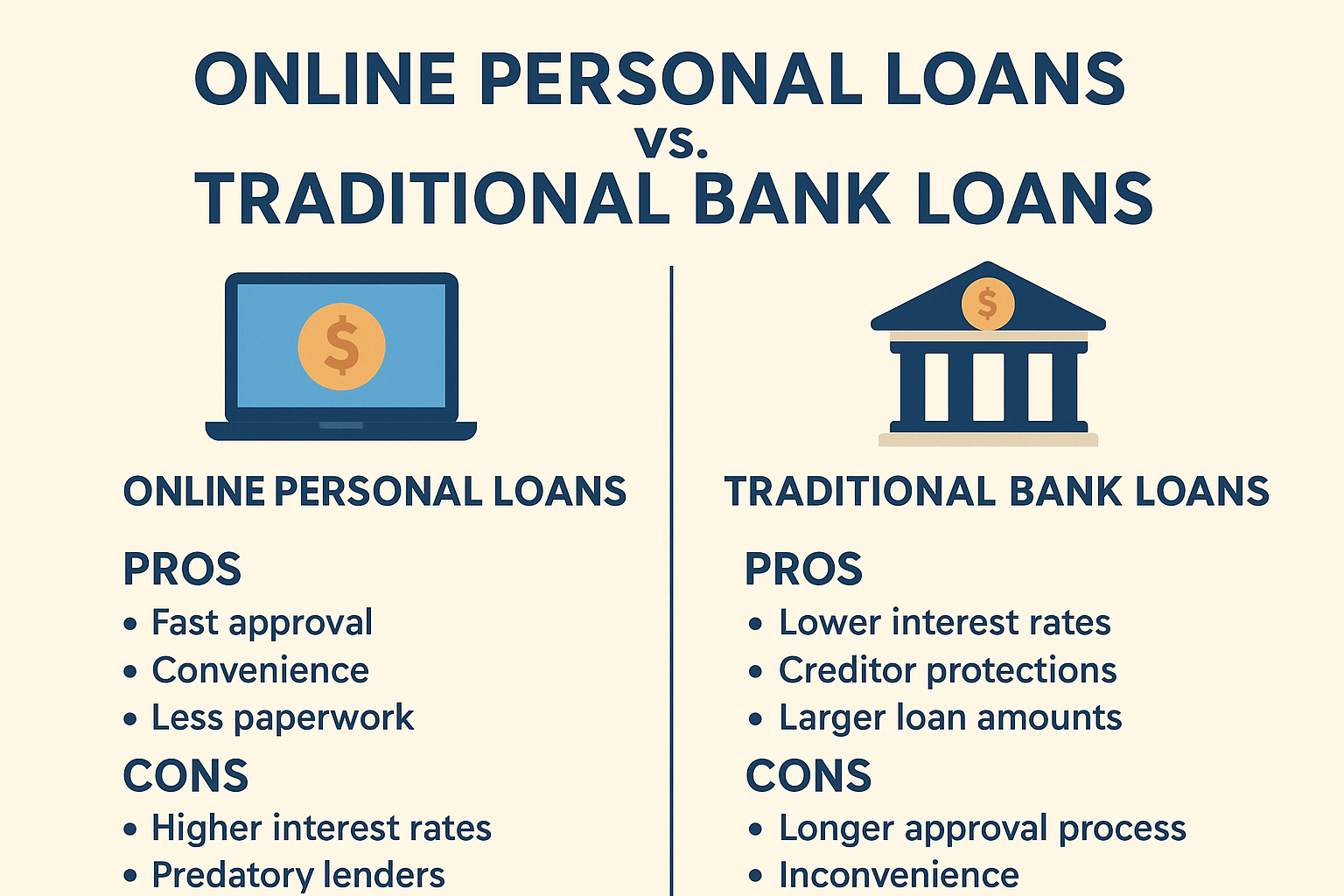

Pros and Cons of Online Personal Loans

Pros

- Convenience: Apply anytime, anywhere, without visiting a branch. The online process is user-friendly and streamlined.

- Speed: Faster approval and funding, often within 24–48 hours, making them ideal for urgent needs.

- Accessibility: Many online lenders cater to borrowers with less-than-perfect credit, offering options for a wider audience.

- Comparison Ease: Online platforms allow you to compare multiple lenders quickly, ensuring competitive interest rates.

Cons

- Higher Interest Rates: Borrowers with lower credit scores may face higher rates compared to traditional banks.

- Fees: Some online loans come with origination fees or prepayment penalties, increasing the overall cost.

- Limited Personal Interaction: No face-to-face support, which may be a drawback for complex financial needs.

- Risk of Scams: Online lending includes less-regulated platforms, so research is crucial to avoid predatory lenders.

Pros and Cons of Traditional Bank Loans

Pros

- Lower Interest Rates: Banks often offer competitive rates, especially for existing customers with strong credit profiles.

- Personalized Service: Direct interaction with loan officers can clarify terms and tailor solutions to your needs.

- Established Trust: Banks are typically well-regulated, reducing the risk of fraudulent practices.

- Flexible Terms: May offer longer repayment periods or customized loan structures, such as secured loans.

Cons

- Slower Process: Applications often require in-person visits and extensive documentation, delaying funding.

- Stricter Requirements: Banks typically demand higher credit scores and more rigorous eligibility criteria.

- Less Accessibility: Limited to those with strong credit or existing bank relationships, excluding some borrowers.

- Inconvenience: Branch visits and manual processes can be time-consuming compared to online options.

Comparing Online Personal Loans and Traditional Bank Loans

Let’s break down the key differences across critical factors to help you decide.

1. Interest Rates and Costs

Online Personal Loans: Interest rates vary widely based on credit. Borrowers with good credit may get competitive rates, but those with lower scores often face higher costs. Watch for additional fees like origination charges.

Traditional Bank Loans: Typically offer lower interest rates, especially for established customers. However, stricter criteria may exclude some borrowers from the best rates.

Smarter Choice: Traditional bank loans are better for those with strong credit seeking lower rates. Online loans suit those prioritizing speed over cost.

2. Application and Funding Speed

Online Personal Loans: Streamlined applications and quick approvals make them ideal for urgent needs like medical expenses or emergency repairs.

Traditional Bank Loans: Slower due to paperwork and in-person requirements, often taking days or weeks for approval and funding.

Smarter Choice: Online loans win for speed and convenience, while bank loans suit those who can wait for better terms.

3. Eligibility and Accessibility

Online Personal Loans: More lenient eligibility, catering to a broader range of credit profiles, including those with fair or poor credit.

Traditional Bank Loans: Stricter criteria, often requiring high credit scores and established banking relationships.

Smarter Choice: Online loans are better for those with lower credit or no bank relationship. Bank loans favor those with strong financial profiles.

4. Use Cases

Online Personal Loans:

- Quick funding for emergencies or unexpected expenses.

- Debt consolidation for high-interest credit card balances.

- Smaller loans for borrowers with less-than-perfect credit.

Traditional Bank Loans:

- Large expenses like home renovations or major purchases.

- Long-term financing with lower interest rates.

- Secured loans requiring collateral, such as a car or property.

Smarter Choice: Online loans are ideal for fast, flexible borrowing. Bank loans are better for larger, planned expenses with lower rates.

Pros and Cons at a Glance

| Feature | Online Personal Loans | Traditional Bank Loans |

|---|---|---|

| Interest Rates | Higher, especially for lower credit | Lower, especially for strong credit |

| Speed | Fast approval and funding | Slower, more documentation |

| Eligibility | More lenient, broader access | Stricter, favors high credit |

| Convenience | Apply online, anytime | In-person visits often required |

| Best For | Emergencies, debt consolidation | Large expenses, long-term financing |

How to Choose the Right Loan Option

Ask these questions to determine whether an online personal loan or a traditional bank loan is better for you:

- How quickly do you need funds? Online loans are faster for urgent needs, while bank loans may take longer but offer better rates.

- What’s your credit profile? Strong credit unlocks lower interest rates at banks. Online loans are more accessible for fair or poor credit.

- What’s the loan purpose? Online loans suit smaller, urgent needs or debt consolidation. Bank loans are ideal for larger, planned expenses.

- Do you value convenience or personalized service? Online loans offer ease and speed, while banks provide face-to-face support.

Tips for Choosing a Loan

For Online Personal Loans:

- Research lenders thoroughly to avoid scams or high fees.

- Compare interest rates and terms across multiple platforms.

- Check for hidden costs like origination or prepayment fees.

For Traditional Bank Loans:

- Leverage existing bank relationships for better rates.

- Prepare all required documentation to speed up the process.

- Consider secured loans for lower rates if you have collateral.

Conclusion

Choosing between online personal loans and traditional bank loans depends on your financial priorities. Online loans offer speed, convenience, and accessibility, making them ideal for urgent needs or debt consolidation. Traditional bank loans provide lower interest rates and personalized service, perfect for larger, long-term financing. Compare rates, evaluate your credit, and align your choice with your needs to make the smartest financial decision.